Your Financial Future Is About to Change Forever (And You Can Feel It)

approx. reading time: 10min

The Uncomfortable Truth About Modern Investing

The investment advice that built your parents' wealth feels increasingly hollow in today's world. You've diligently followed the prescribed path—maxing out index funds, investing in real estate, dollar-cost averaging into diversified portfolios—yet something fundamental feels... broken.

If you're questioning whether traditional financial wisdom still applies, you're not alone. Millions of investors are sensing a shift they can't quite articulate. The rules of the game are changing, and most financial advisors haven't even noticed.

Two Unstoppable Forces on a Collision Course

The Hidden Economic Tension

At the heart of our economic uncertainty lies a fundamental contradiction that most people never see coming. Two massive forces are pulling the global economy in opposite directions, creating a tension that will ultimately reshape how we think about money, investing, and wealth preservation.

Force 1: Money Printing Makes Everything More Expensive

Your government creates money faster than actual economic growth. Since 2008, central banks worldwide have expanded their balance sheets by unprecedented amounts:

- The Federal Reserve's balance sheet grew from $900 billion in 2008 to over $8.9 trillion by 2021

- The European Central Bank increased its assets from €1.3 trillion to €8.6 trillion in the same period

- The Bank of Japan's balance sheet expanded to 138% of Japan's GDP

Every currency unit printed makes everything priced in that currency appear more expensive over time. This isn't inflation in the traditional sense—it's currency debasement. When the money supply increases faster than the underlying economy grows, each unit of currency loses purchasing power.

Force 2: Technology Makes Everything Cheaper

Meanwhile, technological advancement creates deflationary pressure across virtually every industry. Consider these examples:

- Photography: That $3,000 Canon 5D Mark II camera from 2010 that professional photographers relied on? Today's iPhone 15 Pro shoots better video and takes comparable photos

- Computing Power: A smartphone today contains more processing power than NASA used to land on the moon

- Information Access: A $50/month internet connection gives you access to more information than the Library of Alexandria

- Communication: Video calls across continents that once cost hundreds of dollars are now free

This technological deflation is accelerating. Artificial Intelligence is automating tasks across industries:

- Legal document review that took teams of lawyers weeks now takes AI minutes

- Medical diagnoses that required expensive specialists can now be performed by AI with greater accuracy

- Customer service operations are being replaced by chatbots that never sleep

- Content creation, from writing to art to music, is being democratized through AI tools

Jeff Booth's Revolutionary Insight

In "The Price of Tomorrow: Why Deflation is the Key to an Abundant Future," technology entrepreneur Jeff Booth explains why these forces create an unsustainable system. Booth argues that technology naturally drives prices down—this is deflation, and it's actually beneficial for humanity.

Throughout history, technological advancement has made goods and services more abundant and affordable. The printing press made books cheaper. The industrial revolution made manufactured goods accessible to the masses. The internet made information practically free.

However, our current monetary system requires inflation to function. When everything becomes cheaper (deflation), debt becomes harder to repay. Since our entire financial system is built on debt—government debt, corporate debt, consumer debt—deflation threatens the system's stability.

The Tension You Feel: Real-World Contradictions

This fundamental tension manifests in contradictions you experience daily:

Housing: The Productivity Paradox

Housing prices have exploded while construction technology has become more efficient:

- Construction Technology: Prefab housing, 3D printing, automated systems, and improved materials should make homes cheaper to build

- Market Reality: Median home prices in major cities have increased 300-500% over the past two decades

- The Disconnect: Building homes is easier and more efficient than ever, yet they're becoming increasingly unaffordable

Education: Information vs. Credentials

Education costs skyrocket while information becomes free:

- Technology Reality: MIT, Harvard, and Stanford offer free online courses. YouTube university teaches everything from quantum physics to professional skills

- Market Reality: College tuition has increased 1,200% since 1980, far outpacing inflation

- The Disconnect: Access to knowledge has never been cheaper, yet educational credentials have never been more expensive

Healthcare: Innovation vs. Accessibility

Healthcare expenses multiply while diagnostic tools improve and cheapen:

- Technology Reality: Portable ultrasound machines, AI diagnostics, telemedicine, and genetic testing have revolutionized medicine

- Market Reality: Healthcare costs consume an ever-growing share of household budgets

- The Disconnect: Medical technology advancement should make healthcare more accessible, not less

Why This Matters: The System Cannot Hold

The Mathematical Impossibility

Traditional financial planning assumes these opposing forces will somehow balance indefinitely. But this assumption ignores basic mathematics:

The Debt Problem: Global debt levels have reached unsustainable proportions:

- Global debt-to-GDP ratio has reached 356% as of 2023

- Government debt in developed nations averages over 100% of GDP

- Consumer debt levels are at historical highs

The Deflation Threat: When prices fall naturally due to technological advancement, debt becomes exponentially harder to service. If your income decreases (due to deflation) but your debt payments remain fixed, you face financial crisis.

The Central Bank Response: To prevent deflation and debt defaults, central banks print more money, creating artificial inflation. This temporarily postpones the problem but makes it exponentially worse over time.

Why One Force Must Win

These two forces cannot coexist indefinitely. Either:

- Technology wins: Natural deflation occurs, debt becomes unpayable, and the current monetary system collapses

- Money printing wins: Artificial inflation accelerates until currency loses all value (hyperinflation)

Both outcomes destroy traditional investment strategies built on the assumption of controlled, moderate inflation.

The Great Monetary Reset: What's Coming

Historical Precedent

Monetary systems have collapsed before:

- Roman Empire: Currency debasement led to economic collapse

- Weimar Germany: Hyperinflation destroyed savings and led to social chaos

- Argentina, Venezuela, Zimbabwe: Modern examples of currency collapse

The current global fiat system, established in 1971 when Nixon ended gold convertibility, is the first experiment with worldwide paper currencies backed by nothing but government promises.

The Bitcoin Solution

This is where Bitcoin becomes relevant—not as a speculative investment, but as a mathematical solution to a systemic problem.

Bitcoin's Unique Properties:

- Fixed Supply: Only 21 million Bitcoin will ever exist, making it immune to debasement

- Deflationary by Design: As technology makes things cheaper, Bitcoin's purchasing power naturally increases

- Decentralized: No central authority can manipulate its supply or rules

- Digital Native: Perfectly suited for our increasingly digital economy

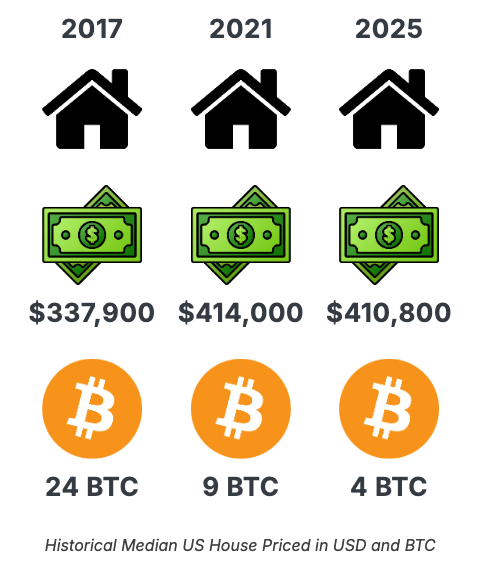

Property Priced in Bitcoin

© 2025 Bitcoin Magazine Pro.

Why Bitcoin Thrives in Both Scenarios:

- If deflation wins: Bitcoin's fixed supply makes it the perfect store of value in a deflationary environment

- If money printing accelerates: Bitcoin serves as a hedge against currency debasement

Taking Control of Your Financial Future

The Paradigm Shift

Understanding these economic forces requires a fundamental shift in thinking:

- From Growth to Preservation: Focus on maintaining purchasing power rather than chasing returns

- From Diversification to Concentration: Traditional diversification fails when the entire system is at risk

- From Passive to Active: Taking control of your wealth rather than outsourcing to traditional financial institutions

The Knowledge Gap

Most financial advisors operate within the current system and cannot imagine alternatives. They're trained to optimize portfolios for a world that may no longer exist.

What You Need to Learn:

- How monetary systems actually work

- Why Bitcoin represents a technological breakthrough, not just another investment

- How to safely acquire, store, and manage Bitcoin

- Risk management strategies for economic uncertainty

Your Next Steps: Education and Action

Recommended Reading

Start with Jeff Booth's "The Price of Tomorrow." This book will fundamentally change how you think about economics, technology, and money. Booth clearly explains why deflation is natural and beneficial, and why our current monetary system fights against technological progress.

Practical Education

Understanding these concepts intellectually is just the beginning. The real challenge is implementation:

- How do you safely buy Bitcoin?

- What are the security risks and how do you mitigate them?

- How much of your portfolio should be in Bitcoin?

- What are the tax implications?

- How do you store Bitcoin securely for the long term?

These aren't simple questions, and getting them wrong can be costly.

The Time to Act Is Now

The economic forces described here aren't theoretical—they're accelerating. Every month of money printing makes the eventual reckoning more severe. Every technological breakthrough increases deflationary pressure.

The question isn't whether this system will change—it's whether you'll be prepared when it does.

If you're ready to move beyond traditional financial advice and learn how to position yourself for this new economic reality, consider taking a structured approach to Bitcoin education.

Ready to take control of your financial future?

Learn the practical skills you need to safely invest in Bitcoin and position yourself for the coming monetary transition. Our comprehensive Safe Bitcoin Investing course covers everything from basic security to advanced strategies, designed specifically for newcomers who want to take control of their wealth.